Easy availability of capital is essential for entrepreneurs at the early stages of growth of an enterprise.

Funding from angel investors and venture capital firms becomes available to startups only after the proof of concept has been provided. Similarly, banks provide loans only to asset-backed applicants.

It is essential to provide seed funding to startups with an innovative idea to conduct proof of concept trials.

Objective Of The Scheme

Startup India Seed Fund Scheme (SISFS) aims to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialization.

This would enable these startups to graduate to a level where they will be able to raise investments from angel investors or venture capitalists or seek loans from commercial banks or financial institutions.

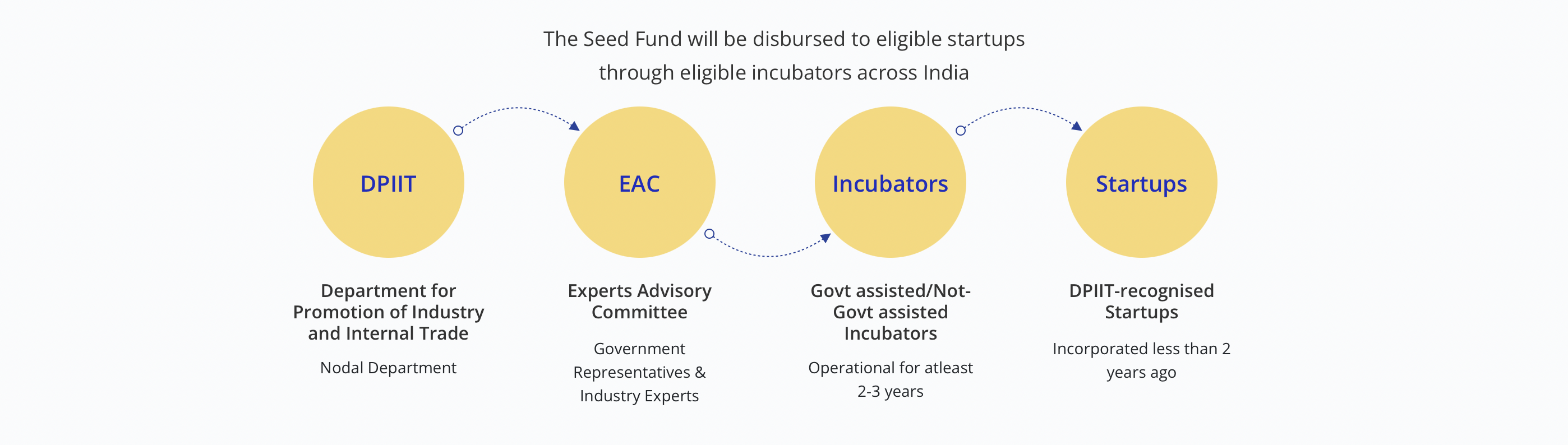

How Startup India Seed Fund Will Operate

Features Of Startup India Seed Fund Scheme

Eligibility Criteria

For Startups

- A startup, recognized by DPIIT, incorporated not more than 2 years ago at the time of application.

To get DPIIT-recognized, please visit https://www.startupindia.gov.in/content/sih/en/startupgov/startup-recognition-page.html - The startup must have a business idea to develop a product or a service with a market fit, viable commercialization, and scope of scaling.

- The startup should be using technology in its core product or service, or business model, or distribution model, or methodology to solve the problem being targeted.

- Preference would be given to startups creating innovative solutions in sectors such as social impact, waste management, water management, financial inclusion, education, agriculture, food processing, biotechnology, healthcare, energy, mobility, defence, space, railways, oil and gas, textiles, etc.

- Startup should not have received more than Rs 10 lakh of monetary support under any other Central or State Government scheme. This does not include prize money from competitions and grand challenges, subsidized working space, founder monthly allowance, access to labs, or access to prototyping facility.

- Shareholding by Indian promoters in the startup should be at least 51% at the time of application to the incubator for the scheme, as per Companies Act, 2013 and SEBI (ICDR) Regulations, 2018.

- A startup applicant can avail seed support in the form of grant and debt/convertible debentures each once as per the guidelines of the scheme.

Incubators

- The incubator must be a legal entity:

– A society registered under the Societies Registration Act 1860, or

– A Trust registered under the Indian Trusts Act 1882, or

– A Private Limited company registered under the Companies Act 1956 or the Companies Act 2013, or

– A statutory body created through an Act of the legislature - The incubator should be operational for at least two years on the date of application to the scheme

- The incubator must have facilities to seat at least 25 individuals

- The incubator must have at least 5 startups undergoing incubation physically on the date of application

- The incubator must have a full-time Chief Executive Officer, experienced in business development and entrepreneurship, supported by a capable team responsible for mentoring startups in testing and validating ideas, as well as in finance, legal, and human resources functions

- The incubator should not be disbursing seed fund to incubatees using funding from any third-party private entity

- The incubator must have been assisted by the Central/State Government(s)

- In case the incubator has not been assisted by the Central or State Government(s):

– The incubator must be operational for at least three years

– Must have at least 10 separate startups undergoing incubation in the incubator physically on the date of application

– Must present audited annual reports for the last 2 years - Any additional criteria as may be decided by the Experts Advisory Committee (EAC)